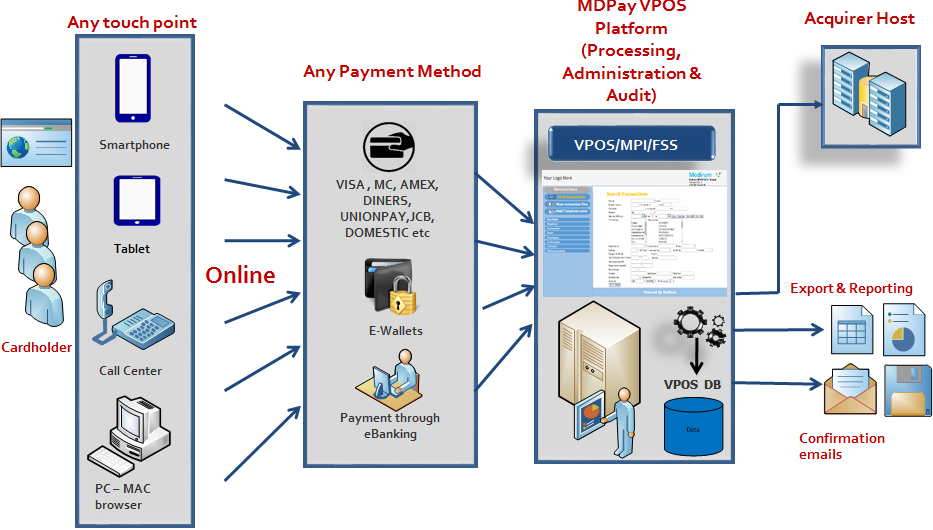

Modirum VPOS is a Payment Gateway for Card Not Present transaction processing and management.

VPOS constitutes the complete solution to enable Acquirers, Processors, PSPs and Retailers to process e-commerce transactions utilizing different payment options and methods, in a multicurrency environment, with advanced security and performance.

VPOS could have enabled a number of payment methods including credit and debit card payments, that are also integrated with Modirum 3-D Secure merchant plugin technology, or additional external payment methods like bank domestic payments, wallets and many other payment methods.

Core design’s implementation of Modirum VPOS enables multiple types of merchant interfaces for incoming transaction processing. Merchants can attach their look and feel to payment pages by supplying their own custom CSS style sheet.

In glance:

- PA-DSS certified

- Software license and Hosted service options available

Key Characteristics

- Integrated 3-D Secure MPI/3DSS ( EMVCo certified)

- Multi- channel support

- High volume OLTP system

- Can support all known acquiring host messaging protocols in a short time

- Provision of incoming transaction interfaces – Redirection (3-D Secure), XML Api (3-D Secure), Batch (mass payments) with VAU support.

- Integrated Fraud Scoring Server

- Multiple payment methods – Credit/Debit cards, Bank Account payments (MyBank), PayPal, Visa Checkout, Masterpass, Domestic and Private Label cards

- Open API for integration with other payment providers

- Built in service for real-time currency rates conversion, shipping costs etc

- Visa Direct & Money Send Support

- Specific support for the gambling industry

- Interface option to integrate with external risk systems

- Option to add new modules

- BackOffice Admin and Merchant interfaces accessible from any device utilizing every known web browser

- Open architecture; any major Operation System, AS & Database software is supported

Functional Features

- Powerfull GUI with advanced user authentication during login (SMS OTP, ModirumID)

- Support of multiple transactions search criteria; results can be exported into csv, pdf and xls formats.(excel and pdf file formats supported upon request)

- Detailed transactions details and history

- Support of all known txn types i.e sale, preauth, capture, void, refund, recurring, installments etc

- Fully customized payment templates

- Ease on administration of daily operations

- Detailed Merchant configuration per processor, per incoming channel, per brand

- Dedicated payment page and payment options configurable on a per processor and merchant basis.

- Complete support and configuration of confirmation emails

Multi-Acquirer support

- Via a Single setup :

- Data segregation for each Acquirer

- URL segregation for each Acquirer

- Service segregation and parameters for each Acquirer and the related merchants

- Ability to support same Merchant MID and TID for all Acquirers

- Separate settlement file per Acquirer

- White label Administrator and Merchant interface

- Standard 3-D Secure Merchant Plugin (MPI) functionality

- Management of acquirer and merchant configuration

- Access to transaction data via MPI/VPOS Admin functionality

- Maintenance of Acquirer Merchant 3-D Secure certificates

Typical implementation timeframe

- A typical VPOS implementation requires 4 - 5 months, assuming:

- Standard functionality implementation (VPOS + MPI + redirection + XML Api)

- Merchant profile data migration

- No extensive customization required (i.e customized incoming transaction interface)

- Bank/acquirer already 3-D Secure certified

- Bank/ acquirer provides protocol and settlement file specifications

- Setup of a single acquirer (multiprocessor installations)

- No Back Office localization required

- Bank Switch/FEP ready to support e-commerce transactions

Warning: Undefined variable $children in

/usr/local/www/data/wordpress/wp-content/themes/mdrm-theme/onecolumn-page.php on line

25

Skip to content

Skip to content

Skip to content

Skip to content